Enquiry telephone

400-680-8962Qingzhou Jinhao new material Co., LTD

Add:No.19, Jingting Street, Caterpillar Industrial Park, Qingzhou City, Shandong Province,China

contact us 2017-9-29

2017-9-29

Overall, the global printing industry is doing well

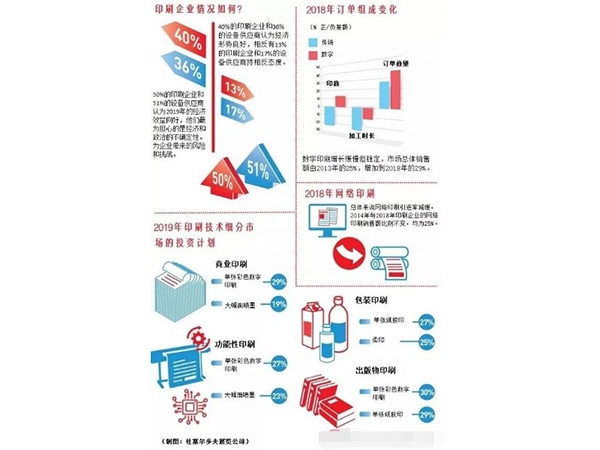

Global printing as a whole is in good shape. Most global indicators have climbed over the past five years, with about 40 percent of print companies saying their companies are in "good" shape, but 13 percent saying they are in "poor" shape. In addition, the results of different regions and markets vary greatly, with North America, Europe and Australia remaining stable growth regions, Asia, the Middle East and Central and South America showing continuous development, while Africa is significantly declining.

Packaging and functional printing continued to grow, while commercial printing and publication printing were shunned

Looking at the market segments, we can see that the packaging and functional printing market continues to grow, and commercial printing and publication printing (except book printing) are getting cold treatment. Participating suppliers generally expressed confidence in the packaging and function market in the survey, and the report in recent years can be seen to be increasingly optimistic about this segment of the market, from 18% in 2014 to 53% in 2017.

Printing companies are increasingly confident in digital transformation

In digital printing, the overall operation cycle is extended, the production lead time is shortened, and the business volume is increasing. However, the proportion of digital printing turnover is only slowly growing, and the proportion of digital printing business in total turnover has slowly climbed from 25% in 2013 to 29% in 2018.

It is worth noting that more and more of the printing companies participating in the survey believe that their businesses will respond to the changing market situation through digital transformation and ultimately succeed. Despite the decline in the overall profit margin of printing companies, in the case of a sharp rise in paper and raw material prices, most printing companies began to focus on improving capacity utilization and cost control to increase sales, from a global perspective, printing wages even slightly increased.

Equipment suppliers have slim profits and increased sales, in which sheet-fed offset printing still dominates

The results of a survey of equipment suppliers show an increase in sales, but significantly thin margins. Although the proportion of digital printing sales has increased, sheet offset is still a commonly used printing technology, and 66% of printing companies still use sheet offset technology for production. The total amount of sheet offset printing continues to grow in the field of packaging printing, but there is a significant decrease in commercial printing.

Equipment investment tends to be positive, and investment is expected to be mainly in post-press processing

In terms of investment spending, printing companies are generally positive: 41% of printing companies increased their investment expenses in 2018 compared to 2017, and only 15% of printing companies invested less. With the exception of Africa, investment spending increased in all regions of the world.

In 2019, the investment target of printing companies is post-press processing, followed by printing technology and pre-press workflow. In terms of printing technology, single-sheet color digital printing technology is the investment direction mentioned in almost all markets. Only packaging printing is an exception, sheet offset printing is the main investment in packaging printing companies, the application of digital printing in the field of packaging only increased by 5%(except for label printing, the application of digital printing in labels reached 40%).

Other aspects, such as the total amount of web printing increased moderately. Compared with 2014, more printing companies introduced network printing in 2018, the proportion rose from 17% to 23%, but the proportion of orders from network printing remained unchanged, and the survey results for both years were 25%.